payment plan for mississippi state taxes

Submit the installment agreement Form 71-661 with the. His annual taxable income is 23000.

Study House Tax Proposal Increases Burden On Poor Mississippians Mississippi Today

Ad Avoid penalties and interest by getting your taxes forgiven today.

. There are several options available. Payment plan for mississippi state taxes. The payor may deduct from Mississippi taxable income the amount of any payments made under a MPACT prepaid tuition contract in the tax year.

What are the tax benefits. On the federal level student debt relief is tax exempt until 2026 due to a provision in the American Rescue Plan Act. But since Mississippi does not require retirees to pay.

Lets take a look at an example provided by the Mississippi Department of Revenue. Can I get a payment plan. Income Tax Self-Service Back New Developments for Tax Year 2021 Back Income Tax Self-Service.

Income Tax Estimate Payments. Mississippis State Tax Payment Plan or Installment Agreement. 2022 Current Resources- Mississippi State Taxes.

Ad Mississippi State Taxes Same Day. Ad Take Advantage of Tax-Smart Investment Tips for Your Portfolio. Download tax rate tables by state or find rates for individual addresses.

If you make a non-qualified withdrawal however the earnings portion will be taxable to a resident recipient. Annual Plan cost 7500. Ad Lookup State Sales Tax Rates By Zip.

Select Make an Estimated Payment from the left hand menu. Funds are not taxed until you withdraw money from the plan. Where do I send my Mississippi state income tax return.

Free Unlimited Searches Try Now. Ad Pay Your Taxes Bill Online with doxo. Free Unlimited Searches Try Now.

Annual 2022 2023. How to Make a Credit Card Payment. Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals.

Mississippi income tax rate. If a taxpayer cannot pay off Mississippi state in one payment due to financial difficulties the MS DOR just like the IRS allows taxpayers to pay off tax liabilities. The standard deduction for No W-4 filed has changed from 4600 to.

Ad Lookup State Sales Tax Rates By Zip. You can make Estimate Payments through TAP. Mississippi does not have some of the tax credits common to other states such as the Earned Income Tax Credit or the Child and Dependent Care Tax Credit.

Mississippi Tax Payment Plan. File the return on or before the due date. If you live in mississippi.

Enrollment Dates for Payment Plans. Contact a Fidelity Advisor. Prepare Your 2021 2022 Mississippi State Taxes Online Now.

Download tax rate tables by state or find rates for individual addresses. You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit card or. Mississippis State Tax Payment Plan or Installment Agreement.

The income tax withholding formula for the State of Mississippi includes the following changes. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. When a Mississippi taxpayer cannot pay off their taxes in certain cases a taxpayer can set up an installment agreement.

But in Mississippi where the state tax code differs from the. John is filing as a single taxpayer in Mississippi. Dates of Enrollment.

Arkansas State Tax Payment Plan Agreement Overview

House And Senate Change Tax Reform Plans But Still No Deal Supertalk Mississippi

Mississippi Eliminates June 75 Estimated Payment Requirement For Withholding Sales And Use Taxes For Certain

Where To Send Your Individual Tax Account Balance Due Payments Internal Revenue Service

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Study House Tax Proposal Increases Burden On Poor Mississippians Mississippi Today

Senate Unveils Income Tax Cut Plan Signaling Battle Among Capitol Leaders Mississippi Today

Mississippi Tax Cut Plan Alive Then Dead Then Alive Again

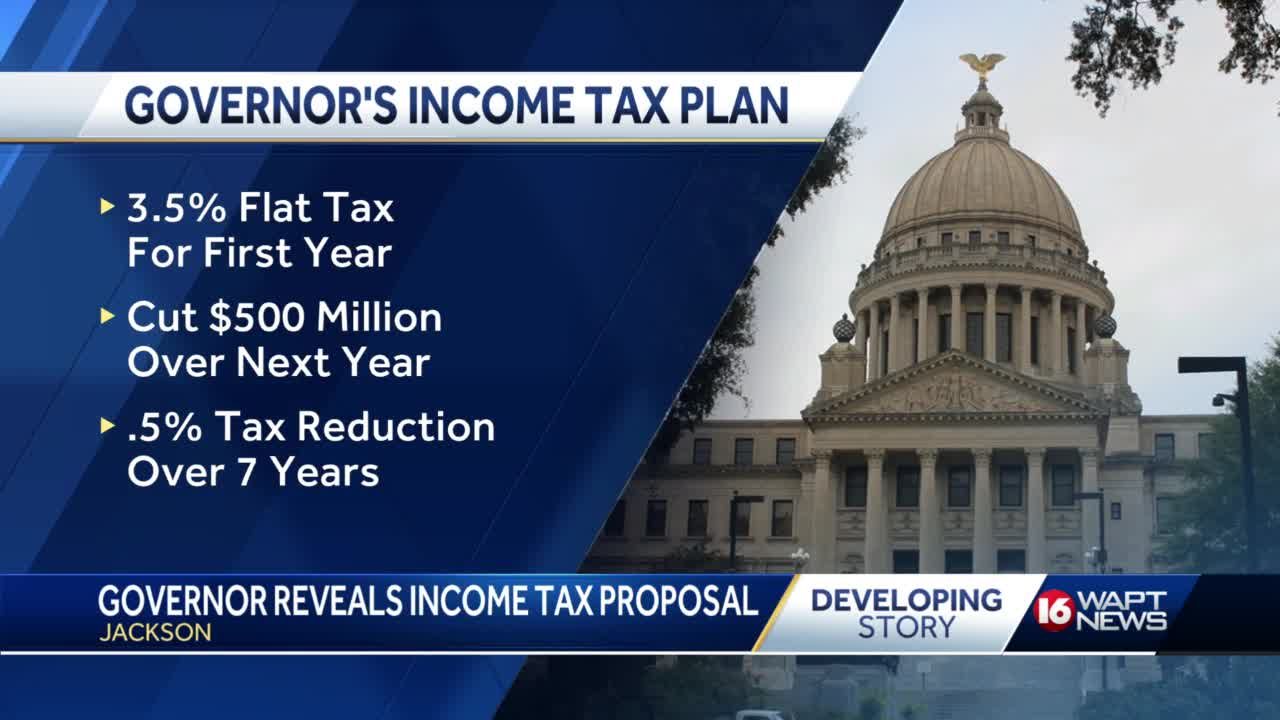

Gov Tate Reeves Reveals Income Tax Elimination Plan

Ar Ms Tn Sales Tax Holidays What You Need To Know Localmemphis Com

State Taxes And Student Loan Forgiveness Ibr Pslf And More

Child Care Strong Mississippi Department Of Human Services

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Mississippi Retirement Tax Friendliness Smartasset

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

States That Won T Tax Your Federal Retirement Income Government Executive

Ohio State Back Taxes Understand Various Tax Relief Options

Mississippi Center For Public Policy Backs Governor S Plan To Eliminate Income Tax Mississippi Thecentersquare Com

Mississippi Plans To Tax Student Debt Relief But Paycheck Protection Program Loans Are Tax Exempt Mississippi Today